Mortgage Insurance vs Life Insurance—do you know the difference? If not, you could be making a costly mistake.

After purchasing a house, there are a million things to do, not to mention getting your financing together, planning your move, and renovating!

As the closing date approaches, your broker emails you the mortgage contract.

You complete it per the instructions, including the attached one-page TD mortgage insurance application. Hey, it could just as well be RBC, Scotiabank, BMO, or Manulife. Take your pick; mortgage insurance from any bank is pretty much the same.

It’s just one of a million papers, so you think nothing of it—it’s a small detail, and you’ve got way more important things to worry about.

The rub is that this piece of paper is very important. Maybe not now, but at some point, when the dust settles, you’re going to take a second look at that fine print and wonder why the heck you signed it.

I will show you why it’s important and how one simple trick can save you thousands of dollars on your mortgage!

Mortgage Insurance vs Life InsuranceThe Nitty Gritty

In the battle of mortgage vs. life insurance, knowing the details before signing the dotted line is important.

Many people think the words mortgage insurance and mortgage life insurance are interchangeable, but there’s a difference.

Real mortgage insurance is the loan protection you must buy from the Canadian Mortgage and Housing Corporation (CMHC) when your downpayment on a new home is less than 20% of the value.

Mortgage life insurance, or creditor life insurance, is a product sold to consumers by banks (usually the financial institution from which you borrow funds to cover your mortgage debt).

It’s confusing because banks market this product using “mortgage insurance.” For example, RBC’s mortgage life insurance product is called RBC HomeProtector Mortgage Insurance.

That aside, the most important thing to remember is that Mortgage life insurance is an insurance policy. Most people who buy a property think it’s in place to protect them, but if you sign that paper, it will protect the lender, not you.

Why Protecting Your Mortgage is All About Protecting Your Income

The term mortgage protection is a misnomer.

When you consider it, your main goal shouldn’t be to protect your mortgage. It should be to safeguard your income. If something happens to your paycheque, cash will NOT be available for your loved ones to continue paying utilities and mortgage payments, providing food, clothing, medicine, etc.

That’s why I think it’s more helpful to consider it “protecting your mortgage” rather than “protecting your income.”

“MORTGAGE PROTECTION = INCOME PROTECTION

How much of your income does your family need to continue to pay your mortgage and all the other living expenses that accrue…”

“…And how long do they need this money for? These are the two questions you should ask yourself when weighing mortgage insurance against life insurance.”

Is Mortgage Life Insurance Mandatory in Canada?

No, It’s not.

One of the most interesting things about evaluating mortgage insurance vs. life insurance is that mortgage brokers in Ontario require you to include a mortgage life insurance application with your documents.

Yep. They can’t make you buy it, but they do have to get you to sign a waiver if you refuse the coverage. It’s part of their compliance protocol, and if you don’t fill out that form, guess what? They don’t get paid.

Because of this technicality, many homebuyers think purchasing mortgage life insurance is mandatory.

You’re so busy scrambling to get everything together for closing it’s an afterthought. So, no, you’re not legally required to purchase mortgage insurance from a bank.

However, if you’re asking me, do you need life insurance for a mortgage? I’d say unequivocally yes! The best place to start is by talking to an independent life insurance broker like Policy Architects.

“Mortgage life insurance is an optional service offered by a third party, in this case, an insurance company. When a Canadian bank offers you an optional service, it must inform you about any charges that will apply. You must also be given the option to opt out of—or cancel—the service.”

Why Use an Independent Life Insurance Agent?

The true value of an independent life insurance broker is their ability to find the right policy for you and your circumstances.

If you’re purchasing a new home, life insurance planning is more important than ever. That’s why I want consumers to know the difference between mortgage insurance and individual term Life Insurance.

A personal life insurance policy works far better than the “coverage” you purchase from a bank when you buy your home. Let’s take a look at the details right now. You’ll thank me because making the right decision here can save you 10’s thousands of dollars over decades.

Mortgage Insurance vs Life Insurance I Recommend Traditional Life Insurance Every. Single. Time.

If you’re confused about the differences between mortgage insurance vs life insurance, you’re not alone.

Most people (major banks included!) use the words mortgage insurance when discussing mortgage life insurance.

Many people also believe purchasing mortgage life insurance is mandatory, which you now know is false. So, I will pause to dispel some myths and clarify this murky topic.

Did you know you can use personal life insurance to protect your mortgage?

A personal term life insurance policy is not tied to your mortgage or your lender. It’s tied to you, and that’s a good thing. A personal life insurance policy follows you like a trusted companion through life’s trials and tribulations, including buying/ selling a home, mortgages, renewals, and refinances.

As long as you’re paying your premium (guaranteed not to increase over your term), it’s waiting to come alive to do its job when necessary. Personal life insurance is the best, most flexible, and cost-effective way to protect your loved ones from financial devastation.

#1 The bank owns your policy and is the beneficiary, NOT your loved ones!

If you select mortgage insurance, it protects the bank. Period.

That’s non-negotiable. This means that if you die, your spouse can’t use the proceeds of the mortgage life insurance to cover any needs other than the mortgage itself.

If you’re the main breadwinner in the family and you’re married, you and your spouse are likely to be listed on the joint mortgage life insurance policy.

If something happens to you, the insurance pays off the balance of your mortgage, which sounds good. But what about the spouse you’ve left behind?

Even though the mortgage is paid off, other expenses include food, clothing, utilities, car insurance, schooling, medicine, entertainment, etc. Is your spouse working? Will he or she have the resources to pay all of this when he or she is financially devastated?

Just because your mortgage is paid off doesn’t mean it’s smooth sailing for those left behind.

If you have a personal life insurance policy, the beneficiary decides how and when the money is spent.

#2 Mortgage life insurance is NOT portable & increases the risk for future application denials!

If you select mortgage insurance instead of life insurance, remember it’s attached to your MORTGAGE.

Every time you switch banks, you must reapply for your mortgage life insurance, and the rate goes up.

If you’re like some people, that’s every mortgage renewal! The bank has a new opportunity to deny coverage if you’ve become uninsurable since your last mortgage application.

This isn’t likely, but it does happen.

Can you imagine? Renewing your mortgage, and suddenly, you have no insurance.

A portable personal life insurance policy follows you through renewals and refinances. When your mortgage is finally paid off, you still have the life insurance if you want to keep it.

#3 Mortgage life insurance doesn’t have guaranteed insurability options

Almost all term life insurance policies allow you to convert or exchange your term coverage for a permanent policy without providing medical evidence.

This is crucial if you become uninsurable – it’s your only way of getting insurance moving forward.

Mortgage life insurance from a bank DOES NOT have this feature.

#4 Mortgage life insurance has a higher potential for claim denials

Mortgage life insurance underwriting doesn’t happen until AFTER a claim is made; therefore, the coverage is NOT guaranteed.

Why is “post-claim underwriting” problematic?

Often, people don’t read or answer the medical questions on the application correctly. They’re in such a hurry to get everything wrapped up for closing they get sloppy.

Not to mention, the questions are unclear and confusing. This opens the door to more potential claim denials, as anything misrepresented or inaccurate on an application is grounds not to pay out the death benefit.

“Erica Johnson (Host): “I think most people assume that once you’ve filled out this health questionairre, if they [the insurance comany] acccept your application and start taking your premiums, they have qualified.”

Jim Bullock (Insurance Expert): “Yes, I know they do and they’re wrong, all they’ve qualified to do is pay premiums. After they die there is a test to see if they actually have insurance.”

When asked in 2020 whether there have been any major shifts in the mortgage insurance market since Marketplace’s In Denial aired ten years ago, Jim Bullock said, ” Nothing has changed in Canada; I still see denied claims.”

Underwriting Works Well For You In the Long Run……but There Are Other Options

With personal life insurance, the carriers do all the underwriting upfront.

Yes, answering all the required questions and completing a life insurance medical exam can take some time. However, once approved, your insurance rates are locked in for your term, which could easily be 20 or 30 years.

As long as you pay your premiums, your insurance is guaranteed and cannot be canceled or modified in any way.

…and regarding traditional underwriting, most major carriers in Canada pay close to 99% of the life claims they receive.

If you have an aversion to blood tests or are worried that you may be at higher risk, no problem. Simplified-issue coverage, or no-medical-life insurance, is a good option.

Depending on your age, you may be eligible for a 30-year policy with Canada Protection Plan and coverage up to $750,000.

In case you’re wondering, this product also comes with a conversion option to permanent insurance, guaranteeing your insurability in the future.

#5 Mortgage life insurance is MORE EXPENSIVE than personal life insurance!

How much more expensive is mortgage insurance vs life insurance?

Let’s find out…I hope you’re sitting down.

Cameron (46 years old) and Stephanie (41 years old) just put a down payment on their 2nd home and are taking out a $500,000 mortgage at TD Bank. If they take the TD mortgage insurance offered to them, they’ll pay $284.31 per month for joint coverage.

…But they could do better. Bank Driven Mortgage Life Insurance is EXPENSIVE! I’m going to get into the 5-year renewal in more detail below.

The mortgage insurance rates between different lenders can fluctuate wildly.

Personal Life Insurance Is Looking PRETTY SWEET

Let’s examine the cheapest bank insurance option (Manulife) and compare it to the most expensive term option (Assumption).

Manulife mortgage insurance costs Cam and Stephanie $273 per month. If they opt for individual 25-year term policies with Assumption Life, the combined price is $183.60 monthly ($125.55 for him + $61.65 for her).

That’s $89.40 less per month—a grand savings of 33%! That’s a huge difference.

Over five years, the cheapest bank option, Manulife mortgage insurance, costs them $16,380, whereas individual 25-year term policies with Assumption set them back $11,016. That’s a difference of $5,364 in just five years!

Remember, their term coverage through Assumption Life is guaranteed for 25 years. This means their monthly cost never increases, and their coverage won’t decrease over the term.

Note: Remember, if you switch lenders during the term of your mortgage, you’ll have to start all over again when it comes to mortgage life insurance, too.

5 Year Explanation

Remember, even though most mortgages in Canada are amortized over 25 years, the standard mortgage is a 5-year fixed term.

This means taking out five separate mortgages to pay off your home is not unusual. How likely are you to stay with the same financial institution for 25 years, and what is your amortization? Do you see what I’m getting at?

Like most people, Cam and Steph have a 5-year fixed mortgage, which means their mortgage life insurance cost remains the same for only five years. A personal life insurance policy guarantees that the cost never increases over the entire amortization period of the mortgage.

Changing Banks Every 5 Years Compounds the Cost

If they switch financial institutions when they renew their mortgage five years from now or do any refinancing, their current mortgage insurance coverage ends. Choosing to “tick” the box for new coverage means their rates increase.

Why do their mortgage insurance costs go up? Cam and Stephanie are five years older and pay the rates associated with someone five years older. Can you see how this could add up after five mortgage renewals when switching banks and/or refinancing?

Please note that in this scenario, even though your mortgage balance is decreasing over time, your mortgage life insurance costs increase. If you want to see how this works, let’s take a gander at some cold, hard numbers over 25 years.

Save 55% – 87% With Personal Life Insurance Over 25 Years!

The cost of housing isn’t cheap in Canada, especially If you live in the greater Toronto area (GTA) or Vancouver.

Some places are more affordable, but a hefty mortgage is not out of the question for many of us. For example, a semi in a good area costs you upwards of $1,000,000 if you live in Toronto, so a $500K mortgage has become common.

A substantial mortgage cannot be amortized over five years, so let’s review it over 25 years to provide a more accurate picture.

Cameron & Stephanie Over 25 Years

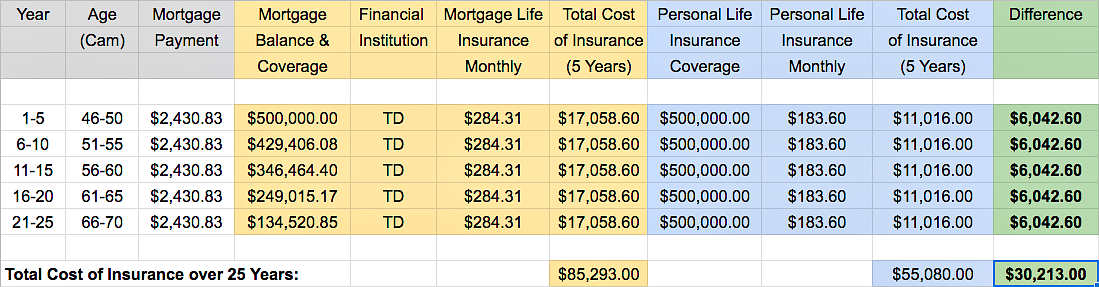

In this example, I’ll use the same clients, Cameron and Stephanie. They have a $500,000, 5-year fixed mortgage amortized over 25 years. Over the course of 25 years, Cameron and Stephanie have paid 55% more for TD mortgage insurance than they would have if they had two individual term policies from a life insurance company such as Assumption Life!

This sounds hard to believe, so let’s double-check the numbers…

…The chart below starts with Cameron and Stephanie getting a $500,000 mortgage and renewing it every five years at the same rate. Notice a few points:

- A declining mortgage balance and coverage

- Personal life insurance cost and coverage remain level for 25 years

- Check out the green highlighted section to see the “difference” they’re paying over each 5-year term of the mortgage

*Figures in table above based on $500,000 mortgage, 5-year-fixed @ 3.25%, amortized over 25 years. Mortgage life insurance quotes based on TD mortgage insurance rates. Personal life insurance quotes based on Assumption Life 25-year term rates. April 2019

Again, the difference in price between mortgage life insurance from the bank and personal term life insurance is massive!

Over 25 years, Cameron and Stephanie pay a whopping 55% more for mortgage life insurance than they do for two 25-year term policies from Assumption Life—a savings of $30,213!

The Numbers Speak for Themselves – Unbelievable!

As you can see in this example, the cost of mortgage insurance compared to life insurance is unreasonably high—up to 55% more!

What will you do with $20,000 – $30,000 savings over 25 years? Will you double your monthly mortgage payments…or sock the cash away in an investment account?

Still not convinced that mortgage insurance sucks? We have one more reason to check the “decline” box.

#6 Mortgage life insurance is Joint Coverage and does NOT pay a double death benefit

Don’t let them fool ya: Joint TD Mortgage Insurance = One Death Benefit

Individual Assumption Life Term Insurance Policies = Two Death Benefits

In case you didn’t know, all mortgage life insurance is joint coverage, which only pays out one death benefit.

If either Cameron or Stephanie passes away prematurely, the TD mortgage insurance—assuming it pays out—pays off the outstanding mortgage balance once, and then the coverage terminates.

The surviving spouse has no life insurance if they need it for other liabilities. So, in effect, you pay all that extra cash for joint mortgage coverage from the bank, but it only pays out once.

With individual life insurance policies, if Cameron and Stephanie were to pass away at the same time, for example, in a car accident, the insurance company would pay out two death benefits.

One goes to Cameron’s beneficiaries and the other to Stephanie’s. That’s a total benefit of $1 million for Cam and Steph’s loved ones vs. $500,000 (or whatever the remaining mortgage balance is) from the mortgage life insurance they purchased from the bank.

Which coverage would you choose?

So, Is Mortgage Life Insurance Worth It?

Let’s review the “cons” of buying Mortgage Life Insurance…

- You’re NOT the owner of the policy; the bank is.

- Your loved ones are NOT the beneficiaries of your mortgage life insurance policy; the bank is.

- Mortgage life insurance is NOT portable, increasing the risk of future application denials.

- A Mortgage life insurance policy DOES NOT have the guaranteed insurability options that 99% of term life insurance policies do.

- A mortgage life insurance policy’s “post-claim underwriting” can result in more claim denials.

- By every metric, mortgage life insurance is MORE EXPENSIVE than term life insurance.

- Mortgage life insurance is sold as joint coverage and pays out one death benefit.

Let’s review the “PROS” of Personal Life Insurance…

- You own the policy, and you decide who the beneficiaries are. Your loved ones determine how and when the tax-free proceeds are spent.

- Your personal term life insurance policy is 100% PORTABLE and follows you through mortgage renewals and refinances at different financial institutions.

- When your mortgage is paid off, you can keep your term insurance in force if needed.

- Term life insurance policies have GUARANTEED INSURABILITY features, including the option to exchange or convert to permanent insurance. This provides security for the future should you become uninsurable.

- Medical underwriting for term life insurance is done at the beginning of the process, “pre-claim.”

- This is the “Gold Standard” in underwriting and one reason traditional insurance pays out a very high percentage of life claims.

- As you can see from the example in #5, Personal term life insurance can be up to 50% CHEAPER than mortgage life insurance from a bank.

- With individual life insurance policies, two death benefits are paid out if both insureds die simultaneously. Not so with bank mortgage life insurance – only one death benefit is paid out.

Mortgage Insurance Vs. Life Insurance – Final Thoughts

What more is there to say? When it comes to the battle of deciding between Mortgage Insurance and Life Insurance, the winner is clear.

Individual life insurance is superior to mortgage life insurance because it protects YOU instead of the lender!

So, if you’re a homebuyer who checked the “accept” box and has, let’s say, Manulife mortgage insurance, don’t worry. Your heart is definitely in the right place.

You should be acknowledged for doing your best to protect your family and home should something ever happen to you.

However, you should know that serious loopholes accompany purchasing mortgage life insurance through the bank. If you want to be sure your loved ones have the highest guaranteed protection, a personal life insurance policy is hands down the best way to go.

I can say that with complete certainty.

Not all insurance is created equal!

If the expense isn’t enough to deter you, you must consider all the other reasons to buy a personal life insurance policy. First and foremost, term life insurance is portable and guaranteed to remain level for 10, 20, or 30-year terms, depending on your choice.

If you want control over the life insurance benefits, term insurance can’t be beaten. Your beneficiary is in complete control of the funds, and underwriting occurs before your policy is put into force. So you can rest easy knowing your beneficiary’s claim will be honored.

You’ll also have the option to convert your policy to permanent coverage without a medical exam. Hmmmmm. I think the facts speak for themselves.

Get in touch with Policy Architects Today! Click the button below for a free life insurance quote.

Fact Checked

Fact Checked

One Response